Cassie Crail

Cassie is a Customer Success Partner at Glean.

Avoid overspending on overcharges and duplicate invoices.

You are a front-line warrior for your company. You protect your organization from erroneous bills every day. You do so by being accurate, detailed, and organized. It is grueling. It is demanding. Billing errors are outrageously common and incredibly difficult to spot. What might look like a small overcharge could turn out to be a recurring problem and end up costing your company tens or perhaps hundreds of thousands of dollars. Your current systems are not fit-for-purpose tools that have been designed to help with common vendor billing problems.

You deserve a better way.

Thankfully, there now is a better way to avoid common vendor billing and payment issues and to protect your company.

Invoice Anomalies & Potential Overcharges

You have a vendor that bills on a monthly basis for its software. The amount is normally $7,500 ($75/user for 100 users). But this month you receive an invoice for $9,500 ($95/user for 100 users). Would Bill.com, QuickBooks, or Brex alert you to this change? Probably not. Instead, the most likely outcome is that the invoice will be entered as usual and paid as usual. Our research shows that organizations could potentially save over 15% on their vendor spend if these anomalies were detected.

Glean’s spend management platform uses historical data and powerful AI technology to detect spend trends and anomalous pricing changes. In the case above, the user would be alerted to the change in unit pricing and be given a head’s up to check the number either internally or with the vendor.

Double Charging

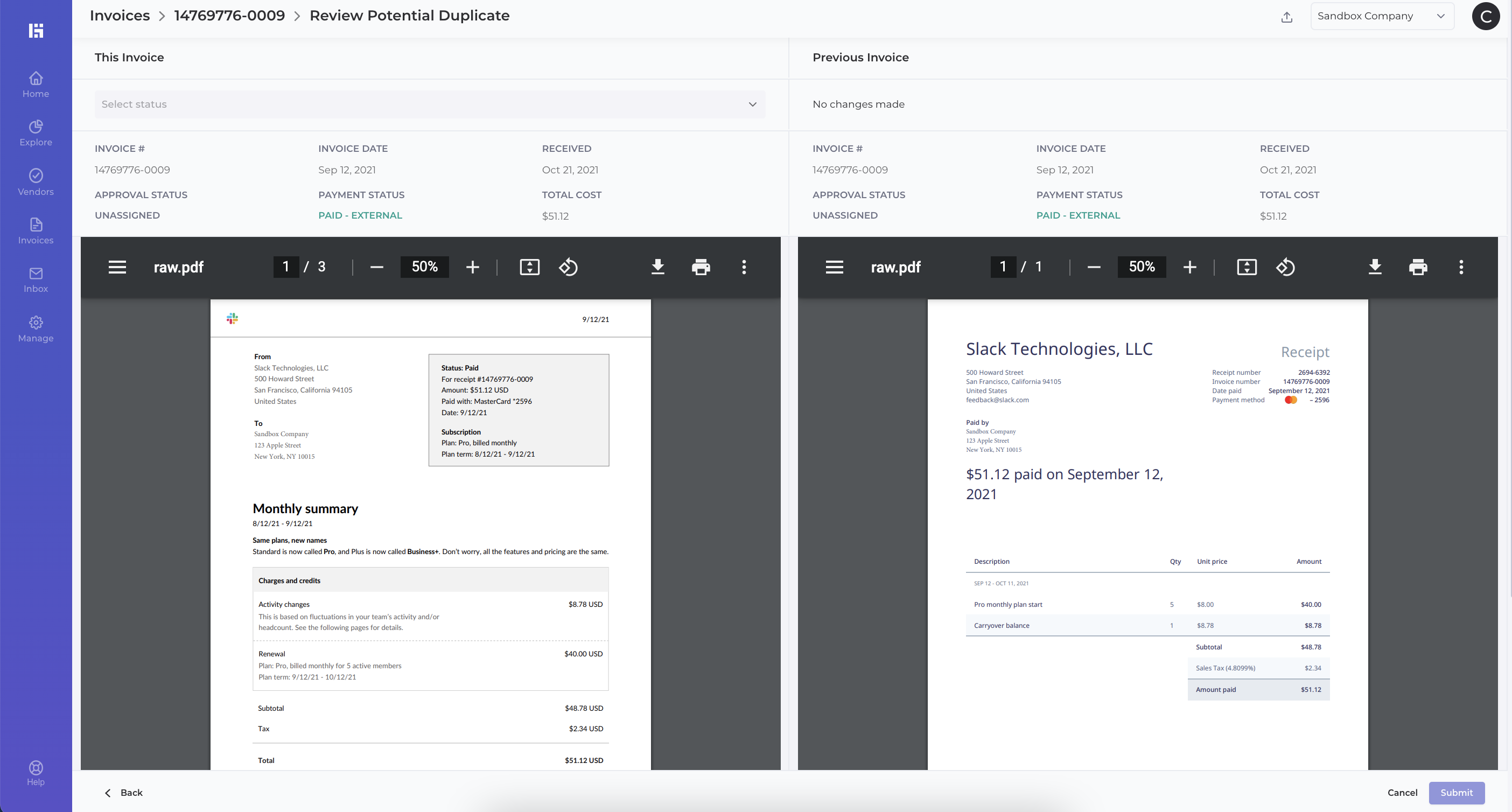

Vendors are well known for mistakenly sending duplicate invoices within a billing period. When this happens in your organization, is it flagged by Bill.com, QuickBooks, or Brex? Probably not. Instead, the most likely outcome is that the duplicate invoice will be entered as usual by your accounting team and paid as usual. And there is a good chance that this error remains undetected.

Glean’s advanced analytics engine studies invoice timing and alerts users to when possible duplicate invoices have been received. This immediately stops the suspect invoice from being paid.

Access to Previous Invoices

Does this scenario sound familiar - a vendor has included new line-item charges on an invoice that were not previously agreed to. You need to see the previous 4 invoices from this vendor so that you can determine when these specific line items were added. Does your current system allow you to easily access these previous invoices? If not, how long does the process take to locate them? How many steps are involved?

Glean’s spend management platform stores all historical invoicing data. Copies of past invoices from any vendor are always just one click away.

Your system works (barely). There is a better way.

Here is exciting news for finance teams that would prefer to use their time for value-added, strategic spend management. In the constantly evolving world of budget management, you can protect your organization from being overcharged. Glean offers AI powered tools that handle the arduous tasks of detecting invoice anomalies, of alerting you to duplicate invoices, and of helping you access previous invoices with just one click.

To learn more about the tools that are now available for teams like yours, contact us at hello@gleancompany.com to schedule a chat at your convenience.